San Diego’s sunshine might be warm, but the reality of Understanding the Costs of Assisted Living in San Diego can send a chill down your spine. We’re peeling back the curtain on those daunting dollar signs to give you clear insights. This means real numbers, like an average monthly tab hitting $5,475—yeah, that’s more than the national norm.

We’ll dive into what makes up these costs and explore options like Medi-Cal that help soften the financial blow for long-term care. From fancy facilities with movie theaters to cozy homes where care is king, we’ve got it all mapped out. And if private pay or insurance puzzles you? Don’t sweat; we unpack those too.

If finding top-notch senior living without breaking the bank sounds good, stick around because knowledge is power—and savings.

Table Of Contents:

- The Financial Landscape of Assisted Living in San Diego

- Evaluating Senior Living Options in San Diego

- Navigating Long-Term Care Insurance and Private Pay Options

- Choosing Lantern Crest as Your Preferred Community

- Insights into Continuing-Care Retirement Communities (CCRCs)

- Financial Assistance Programs Available to Seniors

- Choosing Lantern Crest as Your Preferred Community

- Conclusion

The Financial Landscape of Assisted Living in San Diego

When you’re eyeing the sunny skies and warm vibes of San Diego for your golden years, it’s crucial to talk about the cash. We all know that living in this slice of paradise doesn’t come cheap, especially when you need a hand with day-to-day stuff.

Breaking Down the Average Monthly Costs

So let’s lay it out straight: In San Diego, assisted living will set you back, on average, $5,475 every month. That’s almost a grand more than what folks pay on average across the country, which is around $4,500. Now, don’t drop your coffee mug just yet. This steeper price tag gets you into some pretty snazzy spots where retirees can live large—with everything from pools to theaters at their fingertips.

Digging deeper into these costs means looking beyond just room and board. You’ve got health care services that are top-notch but won’t shy away from charging top dollar. Then there’s skilled nursing care for those who need extra help because life threw them a curveball or two. And don’t forget about those cool extras like movie nights or art classes that make senior living feel less like an extended hospital stay and more like college 2.0.

Medi-Cal and Assisted Living Waiver Program

If reading those numbers made your wallet flinch harder than seeing double digits on the thermostat during summer here—you might want to give California’s Medicaid program (better known as Medi-Cal) a gander for some relief. The Assisted Living Waiver Program could be your ticket to managing long-term care without auctioning off family heirlooms.

This nifty little waiver is California throwing seniors a bone by helping cover part of their cost in certain facilities—those gems among assisted living communities where quality meets affordability head-on (yes they exist.). But remember—it’s not raining waivers. Eligibility rules apply so check them out first before setting heart on this financial lifeline.

Key Takeaway:

San Diego’s assisted living isn’t cheap, averaging $5,475 monthly, but that extra money means top-notch services and some cool perks. If the price tag scares you, look into Medi-Cal’s Assisted Living Waiver Program to save your bank account (and maybe keep those heirlooms).

Evaluating Senior Living Options in San Diego

Yet, choosing between senior living options here isn’t just about finding a place to kick back. It’s about picking a lifestyle that fits like your favorite pair of shoes.

Independent Living vs. Assisted Living Facilities

Sometimes, independence means having the freedom to enjoy life without worrying about household chores. Independent living in San Diego offers this liberty, providing seniors with their own space within communities brimming with amenities—from swimming pools to movie theaters—all without someone hovering over their shoulder. But let’s say you or your loved one needs an extra hand now and then. Assisted living facilities offer help while encouraging as much autonomy as possible.

In these communities, professionals are on standby, ready to support with daily tasks such as medication management or navigating health care needs—because sometimes we all need a little backup plan when our memory starts playing hide-and-seek.

Specialized Care for Memory-Impaired Residents

Moving forward can be tough when memories start fading into foggy patches, but fear not. Memory care in San Diego is tailored by experts who understand cognitive conditions more than most trivia champions know their facts. They craft environments designed specifically for residents facing challenges brought on by conditions like Alzheimer’s or dementia.

Lantern Crest stands out among San Diego retirement communities because it provides compassionate memory care services and its unmatched approach, including therapeutic activities to preserve dignity and spark joy despite life’s hurdles.

California’s Medicaid program (Medi-Cal) and its Assisted Living Waiver Program acknowledge that getting quality long-term care shouldn’t mean emptying every last penny from piggy banks.

So why choose Lantern Crest? Beyond caring staff and lively activities lies real value—care crafted around individuality within walls where laughter echoes louder than TVs ever could. With attention paid closely to both day-to-day wellness checks alongside occasional margarita nights under starry skies—it seems pretty clear why many call Lantern Crest home sweet home.

Key Takeaway:

Choosing the right senior living in San Diego means matching lifestyle needs with care levels. Independent living offers freedom, while assisted facilities provide support for daily tasks. For those with memory impairment, places like Lantern Crest provide specialized care that values joy and dignity.

Navigating Long-Term Care Insurance and Private Pay Options

Choosing the right financial path for assisted living can be as tricky as finding your way through a San Diego maze. But don’t worry, we’re here to light up the trail.

The Role of Long-Term Care Insurance Policies

Think of long-term care insurance like an umbrella on a rainy California day—it keeps you dry when unexpected storms hit. These policies are lifesavers, stepping in to cover costs that regular health insurance won’t touch with a ten-foot pole—like assistance with daily activities or memory care services.

Picking out the perfect policy isn’t just about signing on the dotted line; it’s knowing what you get. It can help foot bills for nursing facilities or home-based senior care, easing financial pressures so families can focus more on quality time than bottom lines.

If private pay is more your speed, picture it as customizing your dream car. But, for healthcare needs—you choose exactly what suits you without relying on preset coverage limits. You directly manage expenses at places like Lantern Crest, where top-tier amenities meet personalized attention.

Genworth’s Cost of Care Survey reveals insights into this dynamic landscape: average monthly fees have soared past national averages, hitting around $5,475 in sunny San Diego.

Private Pay and Medicaid Options for Assisted Living

Digging deeper into payment options unveils another card: Medicaid programs such as California’s Medi-Cal with its Assisted Living Waiver Program. These programs are designed specifically to ease seniors’ journeys into assisted living communities by covering part of their expenses.

This is particularly relevant if you’re eyeing spots like San Diego County, which offer some plush pads complete with swimming pools and movie theaters—a far cry from one-size-fits-all retirement homes.

But let’s dig a littler deeper—the real deal is figuring out eligibility because not everyone qualifies.

So while Uncle Sam might pick up part of the tab via Medicaid options, including California’s Medi-Cal program tailored for folks needing long-term support—not every cent comes courtesy of government coffers.

Instead, many residents rely heavily upon personal funds, which is why ‘private pay’ frequently pops up in conversations over coffee about senior living finances.

It really comes down to choice versus necessity, and knowing the financial implications of each option how each option could mean savings larger than beachfront property price tags.

Key Takeaway:

Think of long-term care insurance as a financial umbrella for rainy days, covering what regular health insurance won’t. Private pay lets you call the shots on your care without preset limits. Don’t forget to check out Medicaid options like Medi-Cal in California, which can help with costs if you qualify.

Choosing Lantern Crest as Your Preferred Community

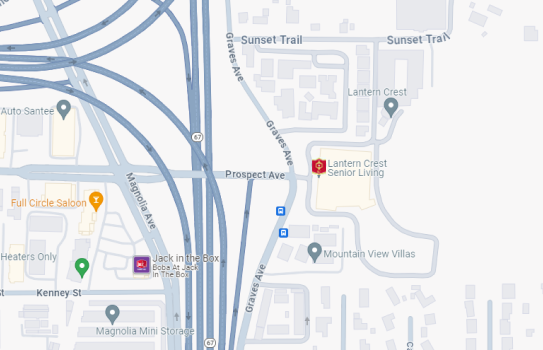

When it’s time to pick a senior living spot in San Diego, the best choice for assisted living is clear: Lantern Crest. Why? Because this community isn’t just about getting by; it’s about thriving with style.

Unmatched Amenities at Lantern Crest

Lantern Crest stands out from other retirement communities like a gourmet chef in a sea of fast-food joints. Here, you don’t just live; you indulge in life. Picture amenities that rival upscale resorts—swimming pools where seniors can enjoy the sunny San Diego weather or movie theaters for entertainment right on your doorstep. It’s not every day you find such luxury mixed with practicality tailored for golden years bliss.

The average month at an assisted living facility can be bland elsewhere, but not here. Imagine starting each morning deciding whether to take a dip, catch a matinee, or simply relax and soak up the California sun without leaving home base. This blend of recreational spaces sets Lantern Crest apart because let’s face it, who wouldn’t want their daily dose of leisure served with variety?

Memory Care Services Tailored by Experts

Caring for loved ones with memory impairments demands more than cookie-cutter solutions—it needs heart and expertise, both of which are core offerings at Lantern Crest. Their specialized memory care services ensure every resident feels safe and understood while providing families peace of mind that only comes when skilled professionals lead the charge.

In these tailor-made programs designed by experts who know what they’re doing (because experience speaks volumes), residents receive individualized attention backed by compassionate support. This winning combo that makes all the difference in navigating cognitive conditions gracefully.

Beyond lavish perks lies real-world pragmatism too—with long-term care costs rising above national averages around $5,475 per month here compared to $4,500 nationally according to Genworth Cost of Care Survey, understanding value is key. And guess what? At Lantern Crest, quality meets cost-effectiveness head-on, offering superior experiences without breaking the bank.

If discussing payment plans gets your head spinning faster than teacups at Disneyland, remember this: sometimes going ‘private pay’ means investing in certainty—the kind assured through exemplary service standards synonymous with top-notch facilities like our own—and often beyond what state-funded programs cover though worth noting Medi-Cal may chip into those pesky bills if eligible.

Key Takeaway:

Choose Lantern Crest for a slice of luxury in your golden years, where every day feels like a resort getaway with tailored care that values heart and expertise. It’s not just living; it’s indulging in life amidst San Diego’s sunshine, with costs that offer real value without skimping on quality.

Insights into Continuing-Care Retirement Communities (CCRCs)

If you’re considering a move to a retirement community, San Diego’s continuing-care retirement communities (CCRCs) offer an all-inclusive lifestyle that can adapt as your needs change. Picture this: one day, you’re enjoying the sunny beaches of San Diego County, and the next, you could be sipping lemonade by the pool without worrying about tomorrow’s healthcare uncertainties.

The unique appeal of CCRCs in San Diego lies in their promise of lifetime housing, social activities, and increased levels of care as residents age. But before packing your bags for such plush quarters, let’s talk dollars and sense—because moving into these luxurious havens requires some financial planning.

It starts with understanding buy-in fees and monthly costs for assisted living within these communities. The initial investment is not just pocket change. It’s a hefty sum. We’re talking about an upfront buy-in fee that secures your place in paradise. But, it buys peace of mind knowing long-term care needs are covered. Alongside this comes a billing system offering different service plans based on individual requirements ranging from independent living arrangements to skilled nursing facility support when needed.

Digging deeper into costs reveals why many find comfort at Lantern Crest, among other choices in San Diego. Its approach balances luxury amenities like swimming pools or movie theaters with expertly tailored memory care services—all under one roof. So, while average monthly expenses might seem steep compared to national averages ($5,475 vs. $4,500), remember those extra perks make life here more than just bearable—they make it downright enjoyable.

To ease the financial burden, though, programs like California’s Medicaid program, Medi-Cal, include an Assisted Living Waiver designed to help eligible seniors manage long-term care expenses without draining their savings too quickly. It shows us how being informed about options makes navigating through them less daunting, especially if private pay isn’t feasible.

All said, CCRCs may well represent senior living at its finest, particularly when paired with comprehensive information found through resources such as the Genworth Cost Care Survey, helping potential residents gauge what they’ll likely spend before making any commitments. And should numbers still intimidate? Just think back on those sunsets over Pacific Ocean horizons waiting outside your new home—it doesn’t get much better.

Key Takeaway:

San Diego’s CCRCs blend luxury with care, offering everything from beach days to memory support. But remember, they’re a big financial step—think hefty buy-in fees and monthly costs. Don’t fret though; options like Medi-Cal can help soften the blow for eligible seniors.

Financial Assistance Programs Available to Seniors

Getting older has its perks, but let’s face it, covering the costs of assisted living isn’t one of them. In San Diego, where the sun kisses your skin nearly every day, and retirement should feel like a never-ending vacation, seniors are often caught off guard by the hefty price tags for quality care.

Breaking Down the Average Monthly Costs

The cost of enjoying your golden years at an assisted living facility in San Diego is not just about having a safe place to hang your hat. It’s about getting help when you need it—whether managing medications or simply making sure you don’t miss breakfast. But this comfort doesn’t come cheap; we’re talking about an average month costs around $5,475 here—almost a grand more than the national average.

If these numbers make you sweat more than a sunny day in July, hold on tight. There’s hope on those palm-lined streets. The good news? Financial assistance programs exist to lighten that load.

Medi-Cal and Assisted Living Waiver Program

To the relief of many senior residents, California offers Medi-Cal—a version of Medicaid designed specifically for Californians needing long-term care without long pockets. And get this: if eligible seniors play their cards right (and why wouldn’t they?), they could tap into the Assisted Living Waiver program, which is like holding an ace up their sleeve when facing high living expenses.

This nifty waiver can help cover some serious ground financially for services within certain participating facilities—it’s not carte blanche, but think of it as silver lining funding amidst costly clouds.

Evaluating Senior Living Options in San Diego

Finding financial aid requires knowing what type of support suits you best—are we lounging independently, or do we need extra eyes keeping tabs? With independent living options aplenty and specialized memory care facilities dotting San Diego’s coastlines too—you’ve got choices tailored just for how much wind is left in your sails.

Navigating Long-Term Care Insurance and Private Pay Options

Surely enough though—for those who’ve planned ahead—the seas might be smoother sailing thanks to policies known as long-term care insurance tucked away somewhere between beach reads and family photos from days gone by; offering coverage helping ensure golden year dreams don’t drown under waves of worry over bills due yesterday.

Choosing Lantern Crest as Your Preferred Community

Sorry, but it seems like there’s been a mix-up. You’ve mentioned wanting to rewrite the last paragraph for better flow and completeness, but I only have ”

In

” provided here. There isn’t enough context or content to work with. Could you provide the rest of the text that leads up to this last paragraph? That way, I can give you a well-crafted conclusion that ties everything together nicely.

Key Takeaway:

Seniors in San Diego can find financial relief through Medi-Cal and the Assisted Living Waiver program to help manage assisted living costs, which average $5,475 monthly—higher than the national average.

Options like long-term care insurance also exist for those who’ve planned ahead, offering a smoother sail into retirement without financial worries.

Conclusion

Understanding the costs of assisted living in San Diego means accepting a higher price tag—$5,475 on average each month. But knowledge is power, and you’re now armed with it.

Dive into Medi-Cal or explore that Assisted Living Waiver; they could be your financial life vests. Remember those luxe spots with pools and theaters? They come at a cost but show what’s possible in senior living spaces.

Navigate through insurance labyrinths or private pay paths; they might just lead to peace of mind. And places like Lantern Crest? They’ve set their sights high on quality care.

Let these insights guide you as you move forward. Because when it comes to finding the right care without needless spending, every bit of know-how counts.